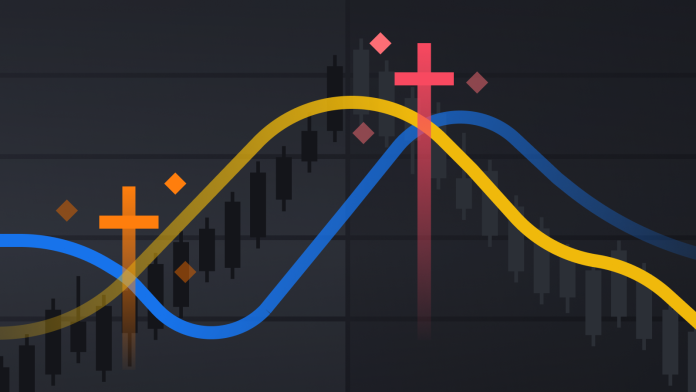

In technical analysis, the terms “Golden Cross” and “Death Cross” are used to describe two important market signals that occur when a short-term moving average crosses either above or below a long-term moving average. These signals are often used by traders and analysts to identify potential changes in trend and to make trading decisions.

Moving averages are commonly used in technical analysis to smooth out price data and identify the overall trend. A moving average is calculated by taking the average price of an asset over a specific period of time. The most commonly used moving averages are the simple moving average (SMA) and the exponential moving average (EMA).

The Golden Cross occurs when a short-term moving average, such as the 50-day SMA, crosses above a long-term moving average, such as the 200-day SMA. This is considered a bullish signal and suggests that the price of the asset may be entering a new uptrend.

Conversely, the Death Cross occurs when a short-term moving average crosses below a long-term moving average. This is considered a bearish signal and suggests that the price of the asset may be entering a new downtrend.

The strength of the Golden Cross and Death Cross signals lies in their ability to identify potential trend reversals. By using moving averages to smooth out price data, these signals can help traders and analysts filter out short-term noise and focus on the longer-term trend of an asset.

One of the strengths of the Golden Cross is its ability to confirm a new uptrend. When the 50-day SMA crosses above the 200-day SMA, it suggests that the price has gained enough momentum to overcome its long-term average. This can provide traders with a strong signal to enter long positions or to add to existing long positions.

Similarly, one of the strengths of the Death Cross is its ability to confirm a new downtrend. When the 50-day SMA crosses below the 200-day SMA, it suggests that the price has lost enough momentum to fall below its long-term average. This can provide traders with a strong signal to enter short positions or to add to existing short positions.

However, it is important to note that these signals are not foolproof and should be used in conjunction with other technical indicators and analysis techniques. Like all technical analysis tools, the Golden Cross and Death Cross signals are not always accurate and can produce false signals, especially in choppy or ranging markets.

Another weakness of the Golden Cross and Death Cross signals is their lagging nature. Since moving averages are based on historical prices, these signals may not always provide timely indications of trend reversals. As a result, traders should use caution and consider other factors when making trading decisions based on these signals.

In conclusion, the Golden Cross and Death Cross are important technical analysis tools that can help traders and analysts identify potential trend reversals. By using moving averages to smooth out price data, these signals can provide valuable insights into the longer-term trend of an asset. However, it is important to use these signals in conjunction with other technical indicators and analysis techniques, as they are not always accurate and can produce false signals in certain market conditions.